All Categories

Featured

Table of Contents

It allows you to spending plan and plan for the future. You can easily factor your life insurance policy right into your budget plan since the premiums never change. You can prepare for the future simply as quickly due to the fact that you understand specifically just how much cash your liked ones will receive in the occasion of your absence.

In these situations, you'll typically have to go with a brand-new application procedure to get a far better rate. If you still need coverage by the time your degree term life policy nears the expiry day, you have a few options.

A lot of degree term life insurance policy policies feature the alternative to renew insurance coverage on an annual basis after the first term ends. the combination of whole life and term insurance is referred to as a family income policy. The cost of your policy will be based upon your present age and it'll enhance every year. This can be a good choice if you just need to expand your protection for 1 or 2 years otherwise, it can get costly pretty swiftly

Level term life insurance policy is just one of the most inexpensive coverage choices on the marketplace due to the fact that it provides fundamental security in the kind of survivor benefit and only lasts for a set amount of time. At the end of the term, it expires. Whole life insurance, on the other hand, is substantially much more pricey than level term life since it does not run out and features a cash money worth function.

Proven Term Life Insurance For Couples

Rates may differ by insurance company, term, protection quantity, health and wellness class, and state. Degree term is an excellent life insurance alternative for most people, yet depending on your coverage requirements and individual situation, it could not be the best fit for you.

This can be a good option if you, for example, have simply stop smoking cigarettes and require to wait 2 or three years to use for a level term policy and be qualified for a lower rate.

Value Term 100 Life Insurance

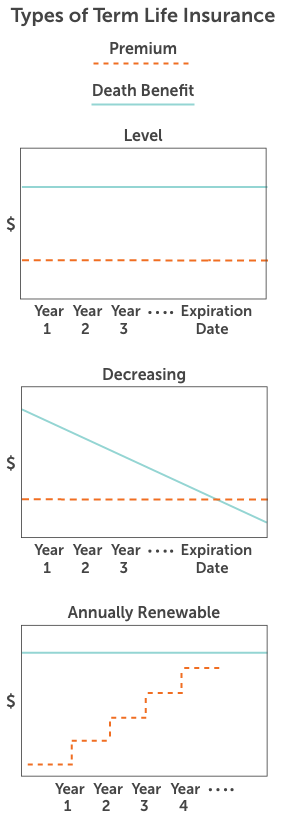

, your fatality benefit payment will certainly reduce over time, however your repayments will certainly stay the same. On the other hand, you'll pay more upfront for less coverage with a boosting term life plan than with a degree term life policy. If you're not certain which kind of plan is best for you, functioning with an independent broker can help.

When you've decided that degree term is ideal for you, the next step is to acquire your policy. Here's how to do it. Calculate how much life insurance policy you require Your coverage quantity ought to offer your family's long-lasting financial demands, including the loss of your income in the occasion of your death, in addition to financial obligations and day-to-day expenses.

A degree costs term life insurance policy strategy allows you adhere to your spending plan while you help shield your family members. Unlike some stepped price strategies that raises annually with your age, this kind of term strategy uses rates that remain the very same through you select, even as you grow older or your wellness adjustments.

Learn a lot more regarding the Life insurance policy alternatives available to you as an AICPA member. ___ Aon Insurance Coverage Providers is the brand for the broker agent and program management operations of Affinity Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Agency, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Solutions Inc.; in CA, Aon Affinity Insurance Solutions, Inc.

Effective Decreasing Term Life Insurance Is Often Used To

The Strategy Representative of the AICPA Insurance Policy Trust, Aon Insurance Policy Providers, is not affiliated with Prudential. Group Insurance policy coverage is provided by The Prudential Insurance Provider of America, a Prudential Financial company, Newark, NJ. 1043476-00002-00.

Latest Posts

Funeral Insurance Definition

How To Sell Final Expense Over The Phone

Funeral Life Insurance For Seniors